Set di 4 Pannelli Fonoassorbenti Isolamento Acustico per Parete e Soffitto Pannelli in Feltro Acustico PET con Listelli in MDF - Rovere Grigio | Leroy Merlin

Pannello decorativo per controsoffitto - FORMBOARD TOP PINE - BALKONAKUSTIK - Bruag Design Factory AG - per parapetto / di rivestimento / leggero

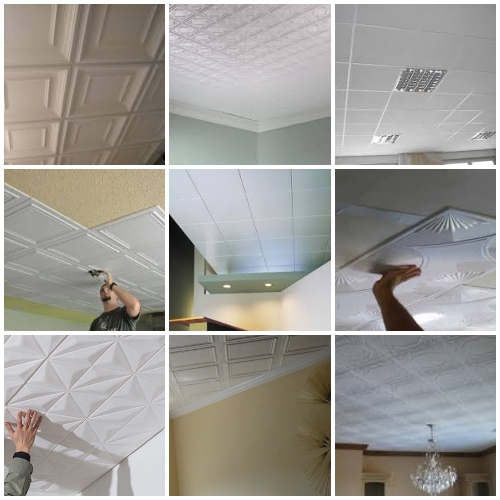

Eurodeco Pannelli decorativi da parete 3D, pannelli da soffitto, pannelli decorativi da parete, in polistirolo, articolo 3D/12 m²-48 pezzi, al quarzo, bianco, spessore 3 mm : Amazon.it: Fai da te

Pannelli in polistirolo per soffitto a prezzi scontati | Decorazioni soffitto, Idea di decorazione, Idee per decorare la casa

50x50cm pannelli decorativi in plastica per pareti 3D, grande onda per soggiorno camera da letto TV sfondo soffitto confezione da 12 piastrelle - AliExpress

48 PEZZI PANNELLO PER SOFFITTO IN POLISTIROLO 50 × 50 x 1,5 cm BOVELACCI TILESTYL HF ROMA – Callegari Vernici

Pannelli da soffitto HEXIM in XPS 100x16,7cm - rivestimento moderno del soffitto in plastica di polistirene (16 metri quadrati P-100.W) pannelli da soffitto adatti per stanze umide : Amazon.it: Fai da te