Organizer per borsa portaoggetti per ombrellone da spiaggia con custodia con cerniera borsa per il trasporto di ombrellone per escursionismo tappetini da spiaggia giardino Patio da campeggio - AliExpress

Ombrellone da spiaggia Ø2 metri con 2 tende laterali da sole e 4 tasche porta oggetti Susy | Leroy Merlin

Borsa Portaoggetti Per Ombrellone Da Spiaggia, Borsa Portaoggetti Per Ombrellone Da Patio, Borsa Pieghevole Per Ombrellone Da Spiaggia, Borsa Portaoggetti Per Ombrellone In Nylon, Borsa Da Trasporto P : Amazon.it: Giardino e

Ombrellone da Spiaggia Ombrellone per molteplici scopi Spiaggia Patio Giardino all'aperto con Strumenti di Fissaggio Borsa portaoggetti Ombrelloni a Ombrello (Colore) : Amazon.it: Giardino e giardinaggio

Ombrellone decentrato rettangolare (L4 x 3m) Yucatan - Bianco e Tortora - Ombrelloni e vele da sole - Eminza

Acquista Secchio portaoggetti per ombrellone per auto da 2 pezzi Secchio per ombrellone appeso Secchio per spazzatura per auto Contenitore per auto multifunzionale | Joom

9 diversi modelli di cassaforte da ombrellone per proteggere i tuoi oggetti in spiaggia - Security Beach

Borsa portaoggetti per ombrello da spiaggia, borsa portaoggetti per ombrellone da esterno da 57 pollici, borsa impermeabile e antipolvere, custodia per il trasporto per ombrellone da spiaggia per : Amazon.it: Giardino e

Organizer per borsa portaoggetti per ombrellone da spiaggia con custodia con cerniera borsa per il trasporto di ombrellone per escursionismo tappetini da spiaggia giardino Patio da campeggio - AliExpress

9 diversi modelli di cassaforte da ombrellone per proteggere i tuoi oggetti in spiaggia - Security Beach

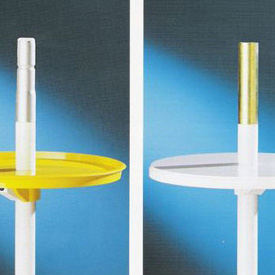

Costway Ombrellone da spiaggia con tavolo e sacchetto di sabbia ancoraggio per la sabbia, Parasole antivento Colorato | FAVI.it

Acquista Secchio portaoggetti per ombrellone per auto da 2 pezzi Secchio per ombrellone appeso Secchio per spazzatura per auto Contenitore per auto multifunzionale | Joom

Borsa portaoggetti per ombrellone da spiaggia da 57 pollici borsa per ombrellone da spiaggia pieghevole borsa per il trasporto impermeabile custodia per ombrellone - AliExpress